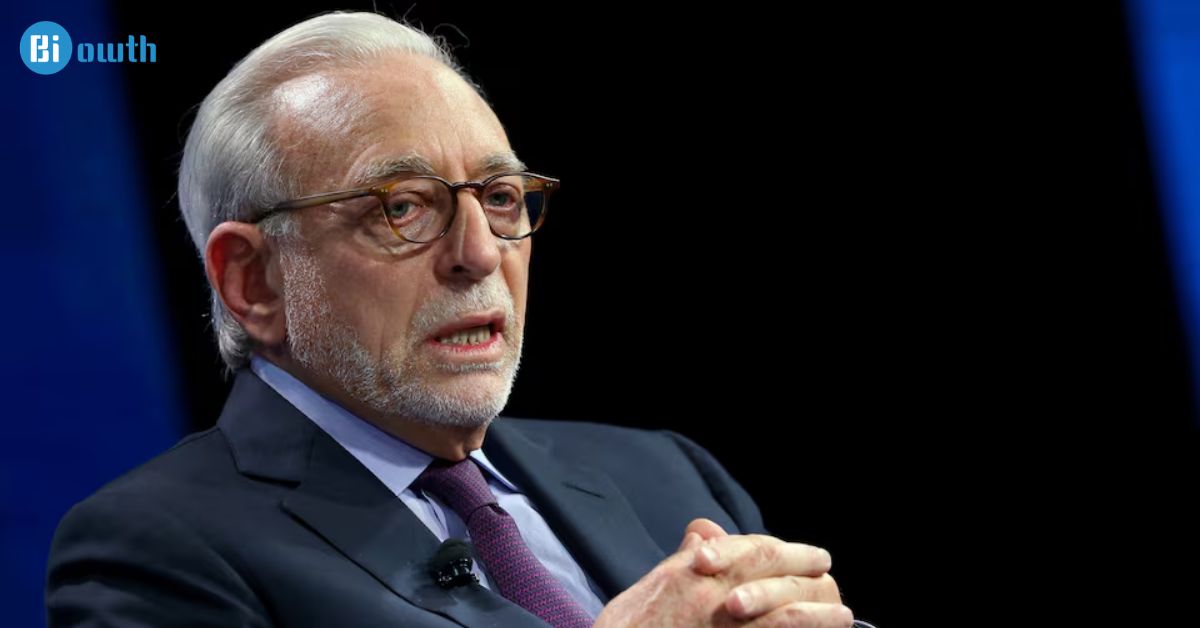

Nelson Peltz is a well-known American businessman and investor whose net worth in 2026 is estimated at $1.8 billion. As a founding partner of Trian Fund Management, he has built a powerful business empire through strategic investments, corporate acquisitions, and hedge fund management. Peltz is famous for high-profile deals, including the Snapple acquisition from Quaker Oats and the consolidation of National Can and American Can, which turned struggling companies into profitable ventures.

Over decades, he has held influential board positions at companies like PepsiCo, GE, Wendy’s, and Mondelez International. His success reflects a combination of financial skill, bold strategies, and a keen eye for growth opportunities.

Overview of Nelson Peltz’s Wealth

Nelson Peltz is a billionaire investor and businessman with an estimated net worth of $1.8 billion in 2026. As a founding partner of Trian Fund Management, he has built a powerful empire in corporate finance. Peltz is widely recognized for his strategic investments, boardroom influence, and success in turning struggling companies into profitable ventures.

His wealth comes from decades of corporate acquisitions, mergers, and hedge fund management. Through careful investment deals with companies like PepsiCo, DuPont, GE, Procter & Gamble, and Mondelez International, Peltz has expanded his fortune. High-profile successes like the Snapple deal and Triangle Industries acquisition showcase his talent for spotting opportunities and creating financial growth.

Early Life and Brooklyn Roots

Born on June 24, 1942, in Brooklyn, New York, Nelson Peltz grew up in a family of entrepreneurs. His grandfather started A. Peltz & Sons, a food distribution business. Peltz learned the value of hard work early, delivering goods as a young man for the family company. These experiences shaped his ambition and drive for building a business empire.

Even as a teenager, Peltz displayed a natural curiosity about business. Growing up in Brooklyn exposed him to a competitive environment, where he observed local companies thriving and failing. These lessons would later influence his approach to corporate strategy and investment. His early life set the foundation for his remarkable journey to becoming a Forbes billionaire.

Education and Career Beginnings

Peltz briefly attended the University of Pennsylvania but left to pursue other opportunities. He became a ski instructor in Oregon and later worked as a delivery truck driver for his family’s company. These jobs taught him discipline, patience, and the importance of understanding business from the ground up.

By the 1970s, Nelson took control of A. Peltz & Sons with his brother and Peter W. May. They expanded aggressively, acquiring dozens of companies and boosting revenue from $2.5 million to over $140 million. The company later went public as Flagstaff, then became Trafalgar, marking the start of Peltz’s rise as a major investor and business mogul.

Building an Empire, Key Business Ventures

Nelson Peltz’s business career is defined by bold acquisitions. His first major success came with Triangle Industries, purchased using financing from Drexel Burnham. This company became a launching pad for larger deals and demonstrated Peltz’s skill in corporate finance.

Over the years, Peltz expanded into several sectors. His board positions at Wendy’s, Legg Mason, Ingersoll Rand, and H.J. Heinz allowed him to influence corporate policies and financial strategies. Each investment and acquisition built on his growing family wealth and solidified his reputation on Wall Street as a shrewd and disciplined investor.

Junk Bonds and Major Financial Moves

In the early 1980s, Peltz and Peter W. May leveraged high-yield bonds, also known as junk bonds, to acquire large corporations. With the help of Michael Milken at Drexel Burnham, they purchased Triangle Industries using almost entirely borrowed money, demonstrating a daring approach to corporate takeovers.

This strategy proved highly profitable. By refinancing debts and selling off non-core assets, Peltz turned Triangle Industries into a billion-dollar success. His use of junk bonds became a case study in smart financial risk-taking and reshaped how investors approach acquisitions in the United States.

Famous Deals, Snapple, National Can, and Others

Nelson Peltz became famous for high-profile acquisitions. Triangle Industries purchased National Can Corporation and later merged with American Can, creating the world’s largest can company at the time. The deals were largely financed through high-yield bonds, showing his mastery of corporate finance.

Another landmark success was the Snapple deal. Peltz purchased Snapple from Quaker Oats for $300 million and sold it three years later to Cadbury Schweppes for $1 billion. Over the years, his investments in PepsiCo, DuPont, GE, and Procter & Gamble further enhanced his business empire. These deals exemplify his talent for spotting undervalued companies and maximizing returns.

Boardroom Battles and Corporate Strategies

Peltz is known for his aggressive approach in boardrooms. He has engaged in multiple corporate battles, often advocating for changes in management and strategy to improve shareholder value. His reputation as a tough negotiator is well-earned through high-profile proxy fights.

These battles were not just about profit; they highlighted his strategic thinking. Companies like Mondelez International and Wendy’s benefited from his expertise in corporate governance and financial planning. Peltz’s strategies show how a sharp investor can shape a company’s future while increasing personal net worth.

Celebrity Connections and Media Influence

Nelson Peltz’s family and social connections have placed him in the media spotlight. His children, including Nicola Peltz actor and Will Peltz actor, have made headlines in Hollywood. The family’s visibility has contributed to a unique blend of business and celebrity influence.

Peltz also engages with high-profile figures in business and entertainment. His connections amplify media coverage of his ventures, enhancing public awareness of his wealth and investments. These relationships demonstrate how celebrity connections can intersect with Wall Street influence to shape a billionaire lifestyle.

Personal Life, Family, Lifestyle, and Philanthropy

Nelson Peltz has been married three times and has ten children, eight with his current wife, Claudia Heffner. His family life is closely intertwined with his business interests, with children involved in entertainment and philanthropy.

The Peltz family is active in charitable efforts. Their philanthropy focuses on education, healthcare, and community development. Despite immense wealth, Nelson maintains a disciplined lifestyle and emphasizes family, creating a balance between luxury living and responsible social engagement.

Real Estate and Luxury Assets

Nelson Peltz owns the 13-acre Montsorrel estate in Palm Beach, Florida, featuring a 48,000-square-foot main house and an 18,000-square-foot guest home. He also holds properties in New York and California, adding to his real estate portfolio.

His estates reflect both luxury and strategic investment. Montsorrel alone carries a $92 million mortgage, with annual property taxes of $1.7 million. The combination of luxury homes and investment properties shows how Peltz grows wealth beyond traditional corporate ventures.

Nelson Peltz Net Worth Breakdown, Sources and Spending

Nelson Peltz’s net worth in 2026 comes from multiple sources. The table below summarizes major contributions:

| Source of Wealth | Estimated Value (2026) |

| Trian Fund Management Holdings | $500 million |

| Triangle Industries & Mergers | $800 million |

| Snapple & Beverage Deals | $200 million |

| Board Positions & Dividends | $150 million |

| Real Estate Portfolio | $150 million |

Peltz’s spending includes philanthropy, investments, and luxury lifestyles. The combination of strategic investments and boardroom influence sustains his business empire and ensures continuous financial growth.

Legacy, Succession, and Future Plans

Nelson Peltz focuses on succession planning to preserve his legacy. He prepares his children and heirs for leadership roles in Trian Fund Management and other ventures. This ensures that the Peltz family wealth continues to grow and influence the corporate world.

His vision extends beyond wealth. Peltz aims to leave a lasting mark in business, philanthropy, and corporate governance. Future plans include more strategic acquisitions, expanding Trian’s reach, and mentoring the next generation of investors, securing his billionaire status and legacy for decades to come.

I am a professional writer specializing in culture, media, and heritage, delivering unique, well-researched stories that inspire readers.